Our Purpose

Future Fortunes Academy provides physical, digital, and online resources that make money concepts simple and practical for children ages 8–14. Our financial literacy programs are designed for use at home, in classrooms, and in community settings, helping kids build real-world money skills they can use for life.

When children learn to understand money - its risks, opportunities, and impact - they grow into adults who make smart financial choices. These future leaders not only manage their own finances wisely but also understand how money decisions affect their families, communities, and even the economy as a whole.

Our Customers

Families

Give your child the financial head start you wish you had.

Our engaging resources make it fun and easy for parents to teach kids real-world money skills at home - no finance degree required. With interactive tools and simple lessons, children build confidence, learn smart money habits, and develop financial literacy that will prepare them for a brighter future. Create meaningful learning moments together and raise money-smart kids for life.

Companies & Organizations

Shape tomorrow's leaders through early financial education.

Whether you’re a financial institution, nonprofit, or employer, we provide tailored financial literacy solutions to support your community initiatives and employee families. Partner with us to create lasting impact through financial education that empowers future generations.

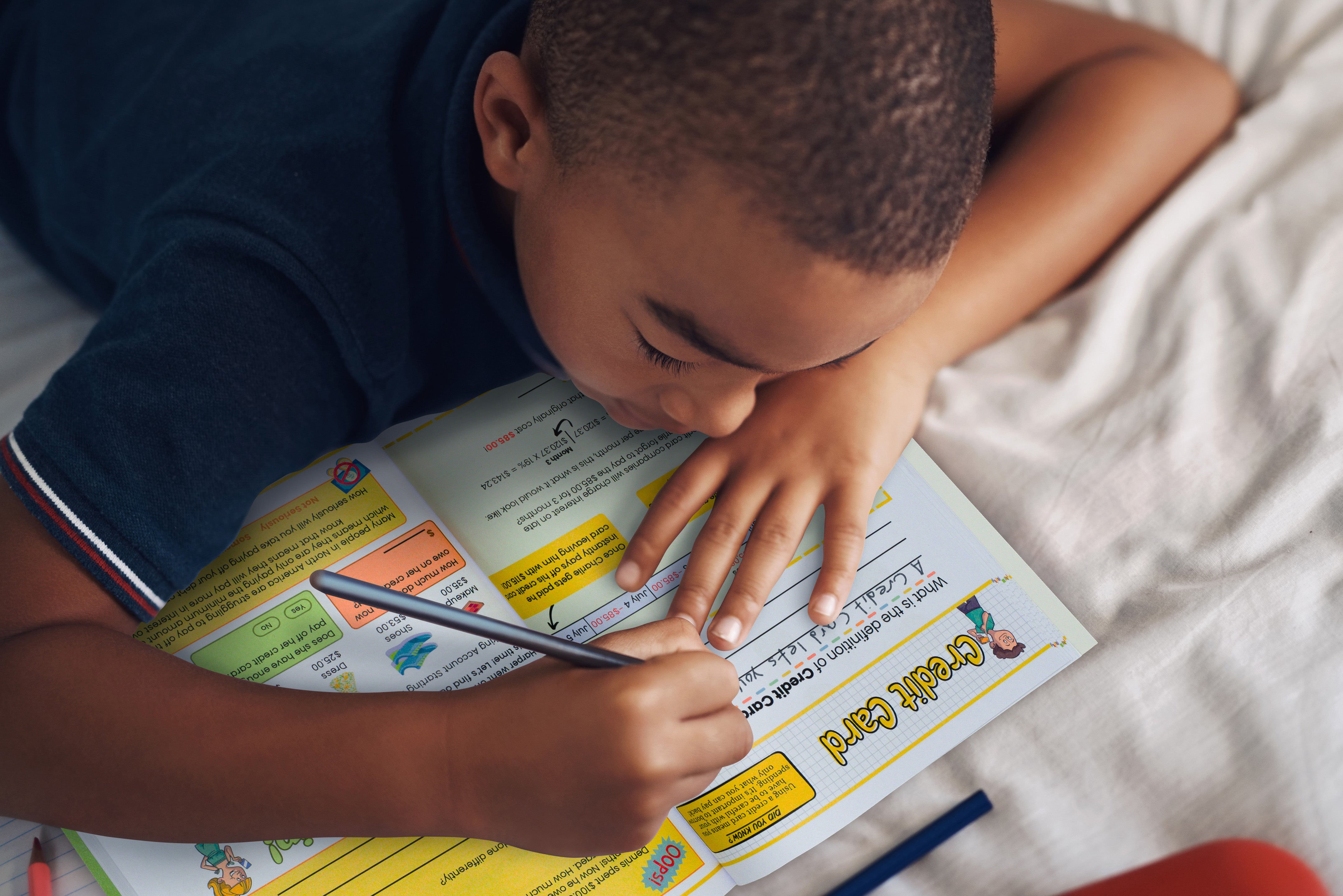

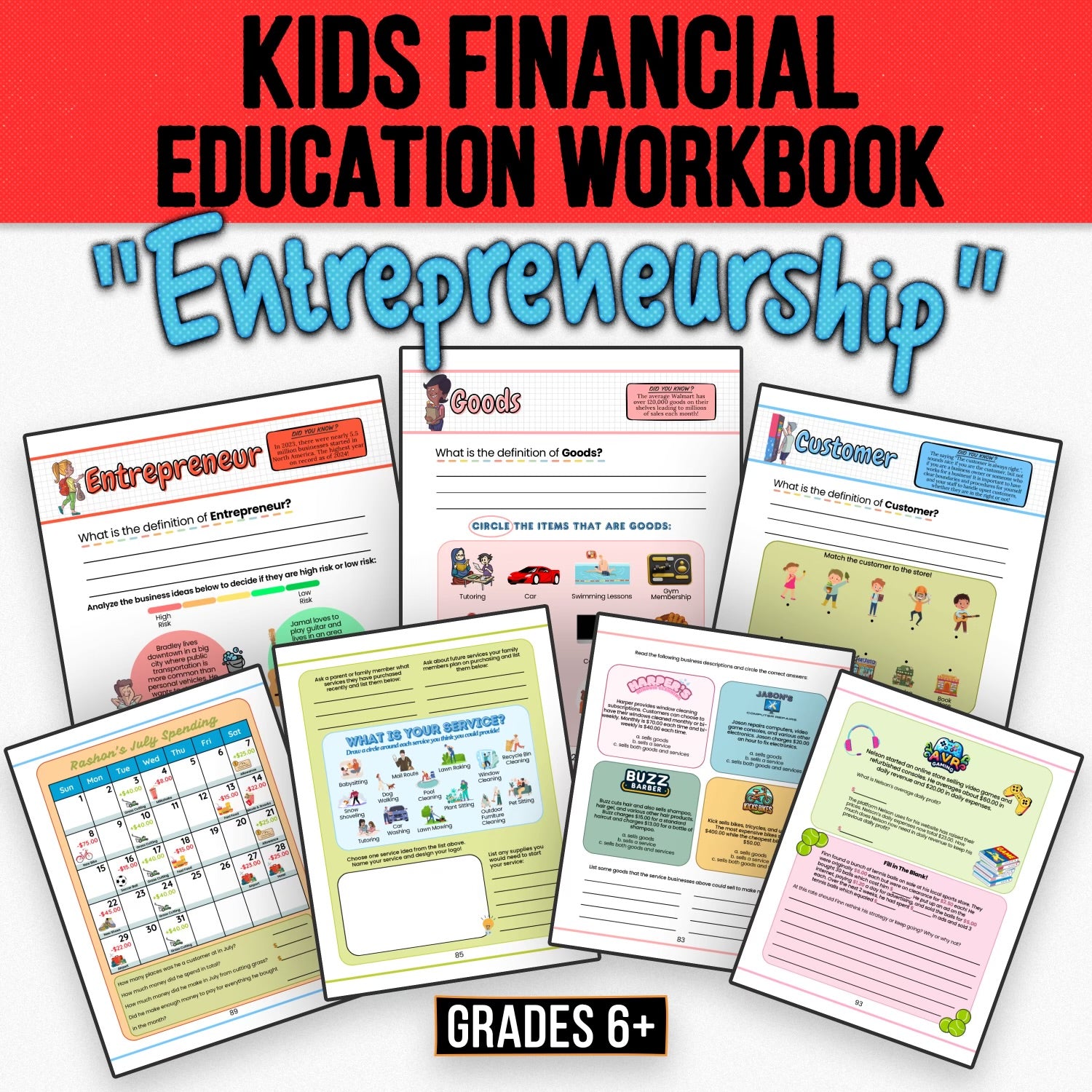

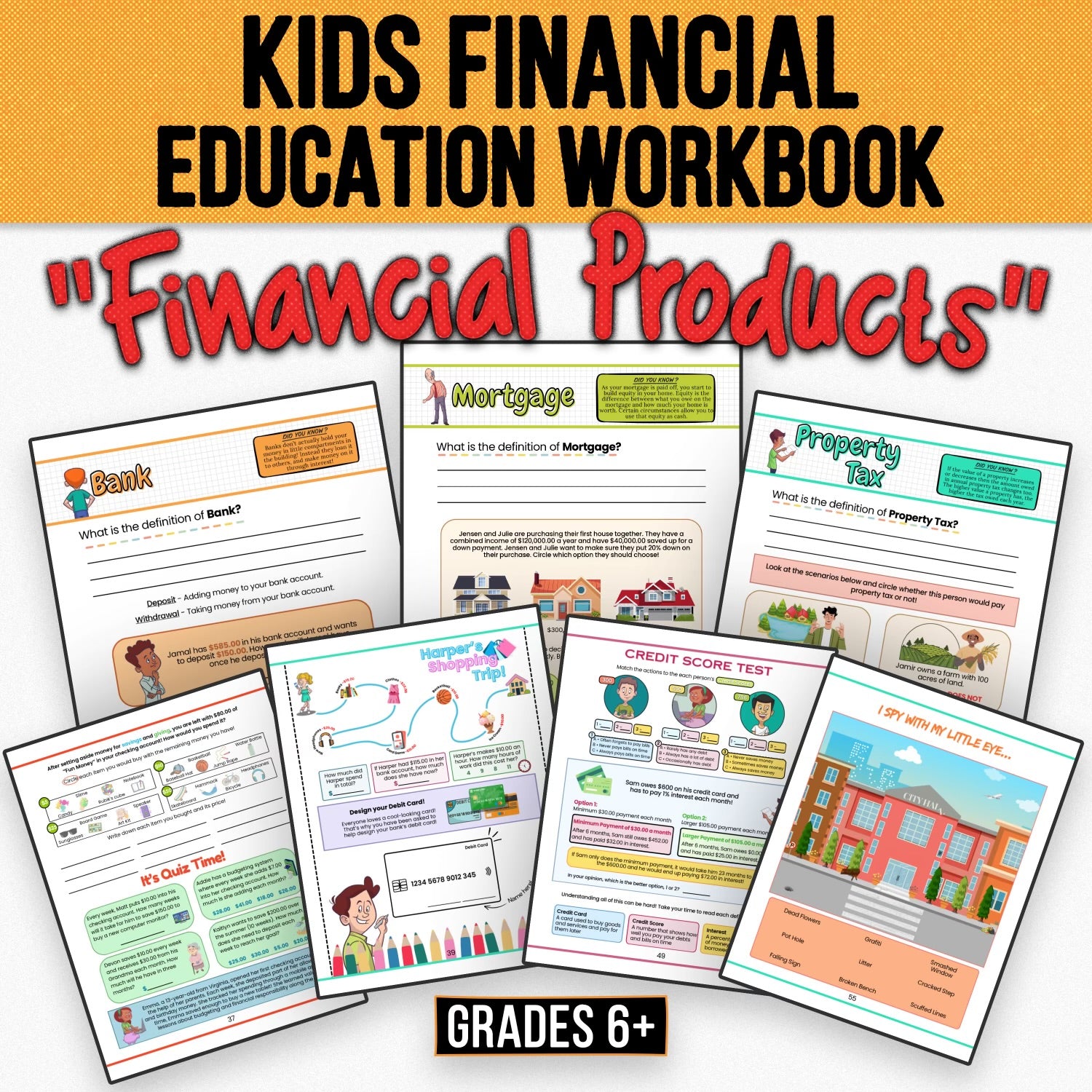

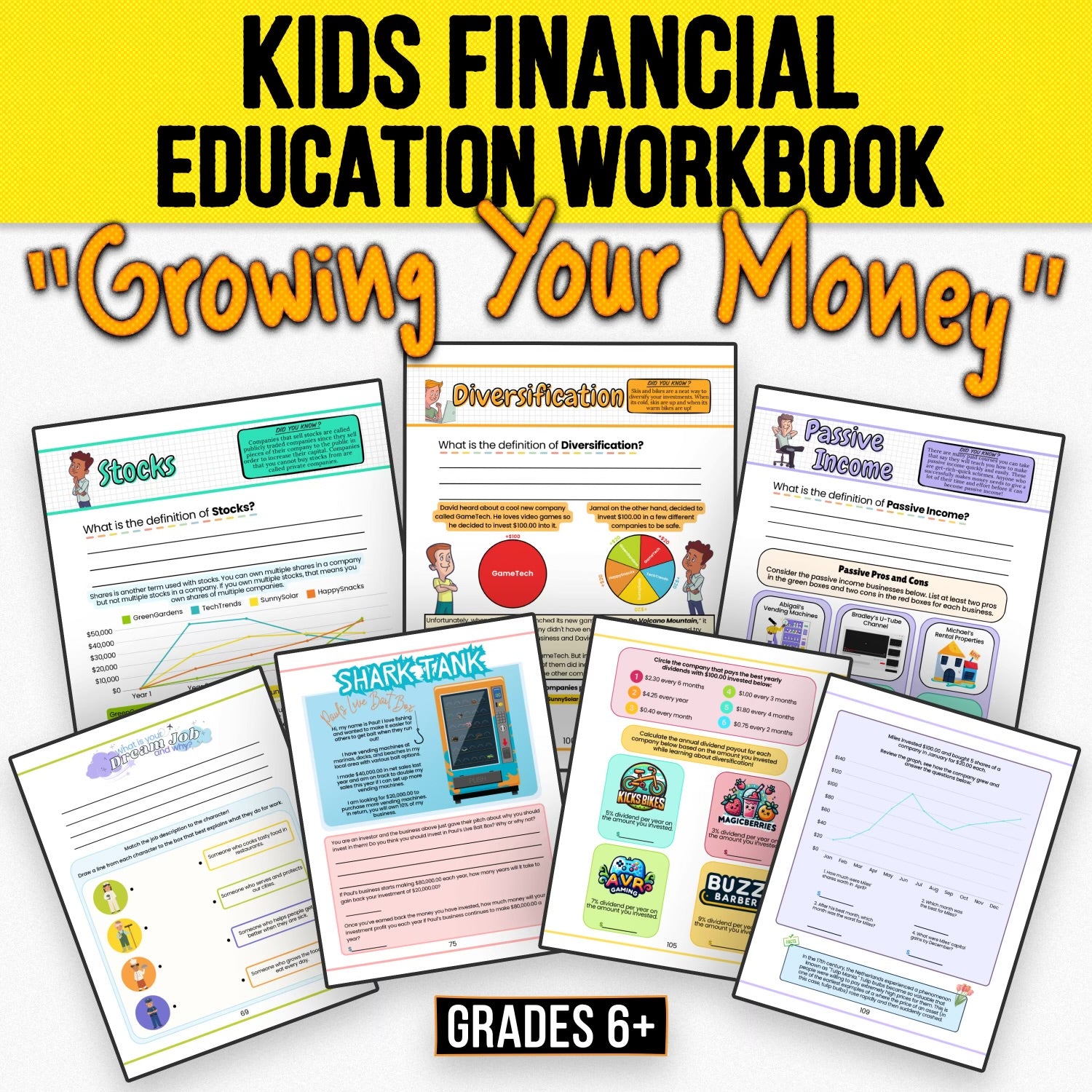

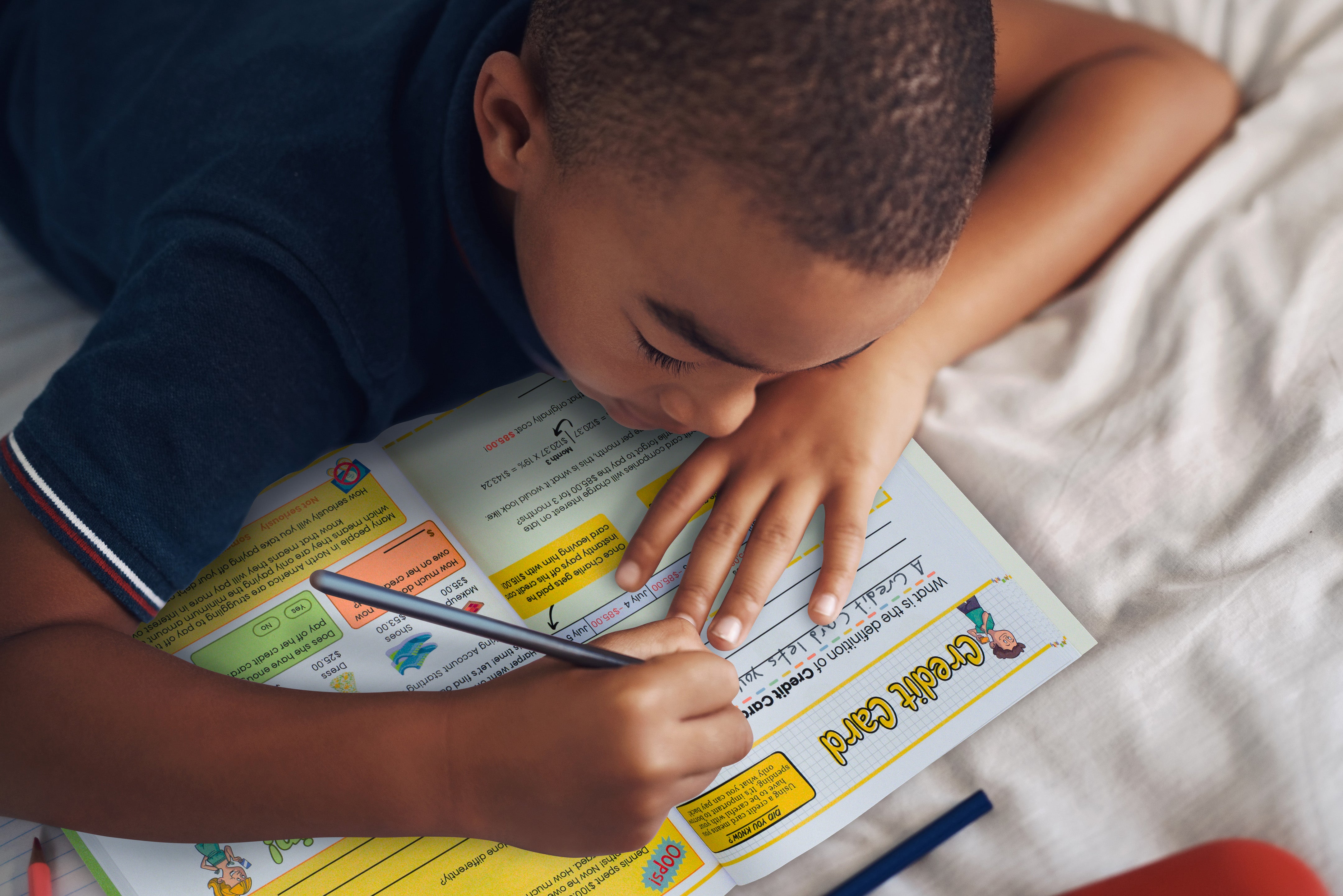

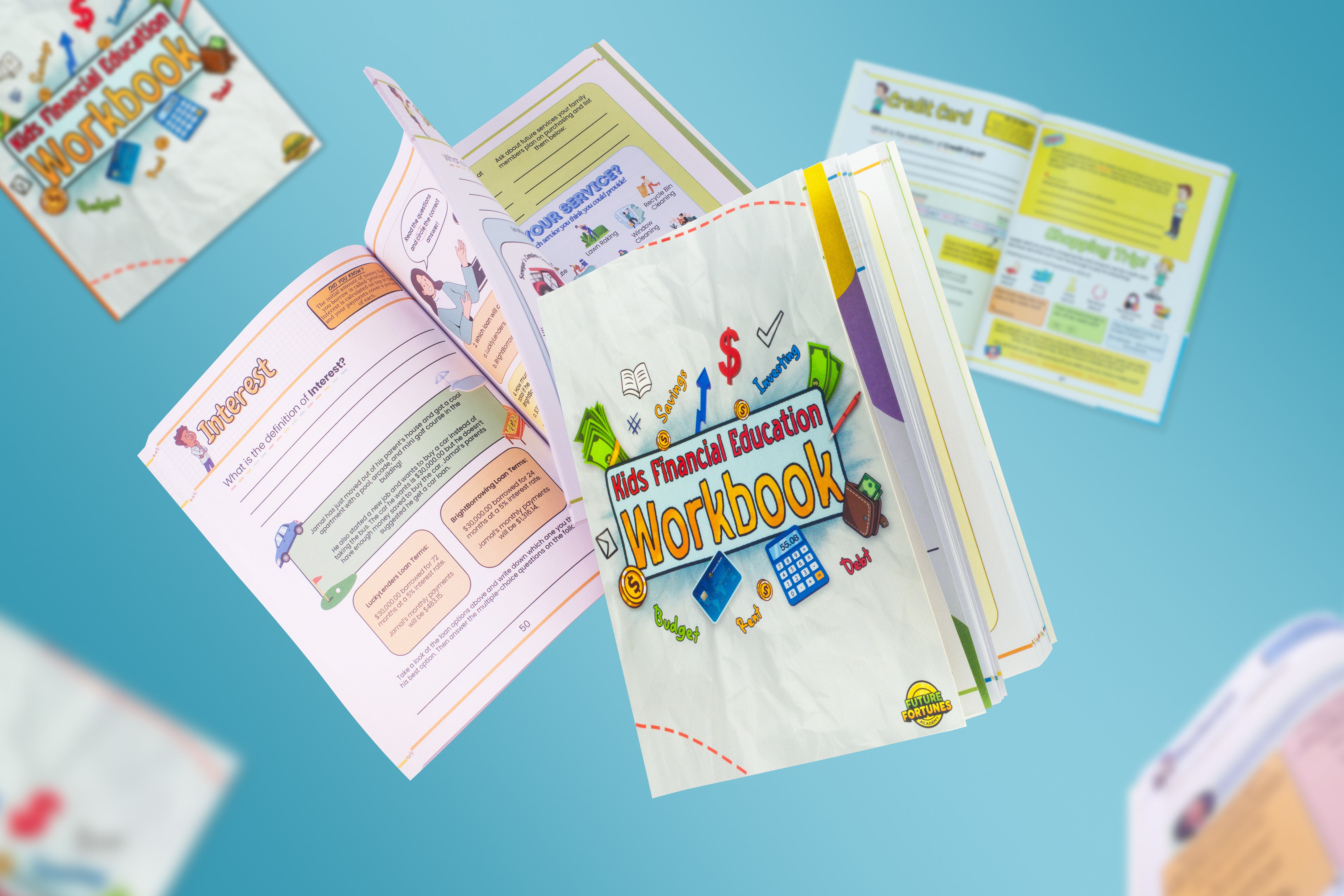

Financial Education Workbook

Empower Your Child with Financial Literacy

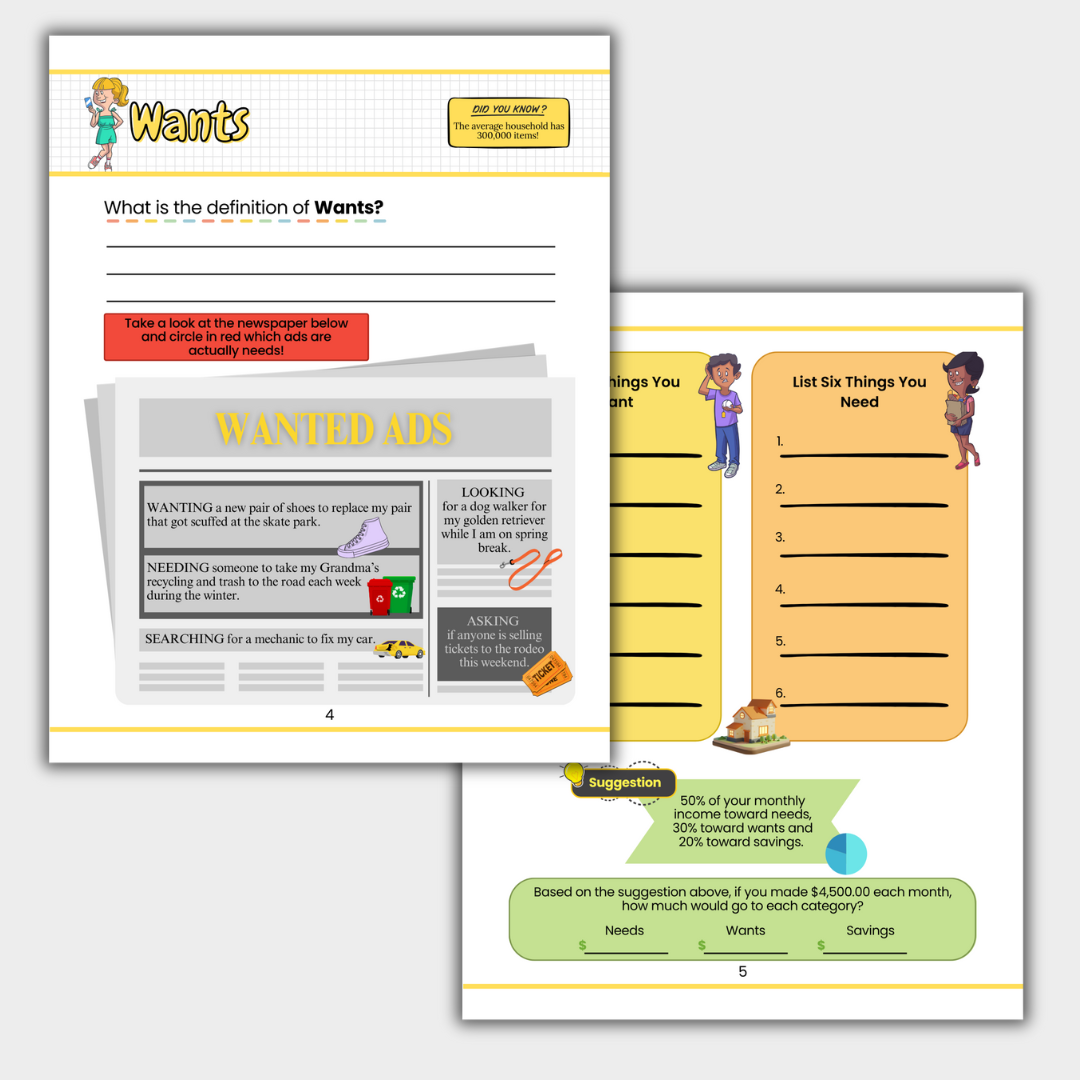

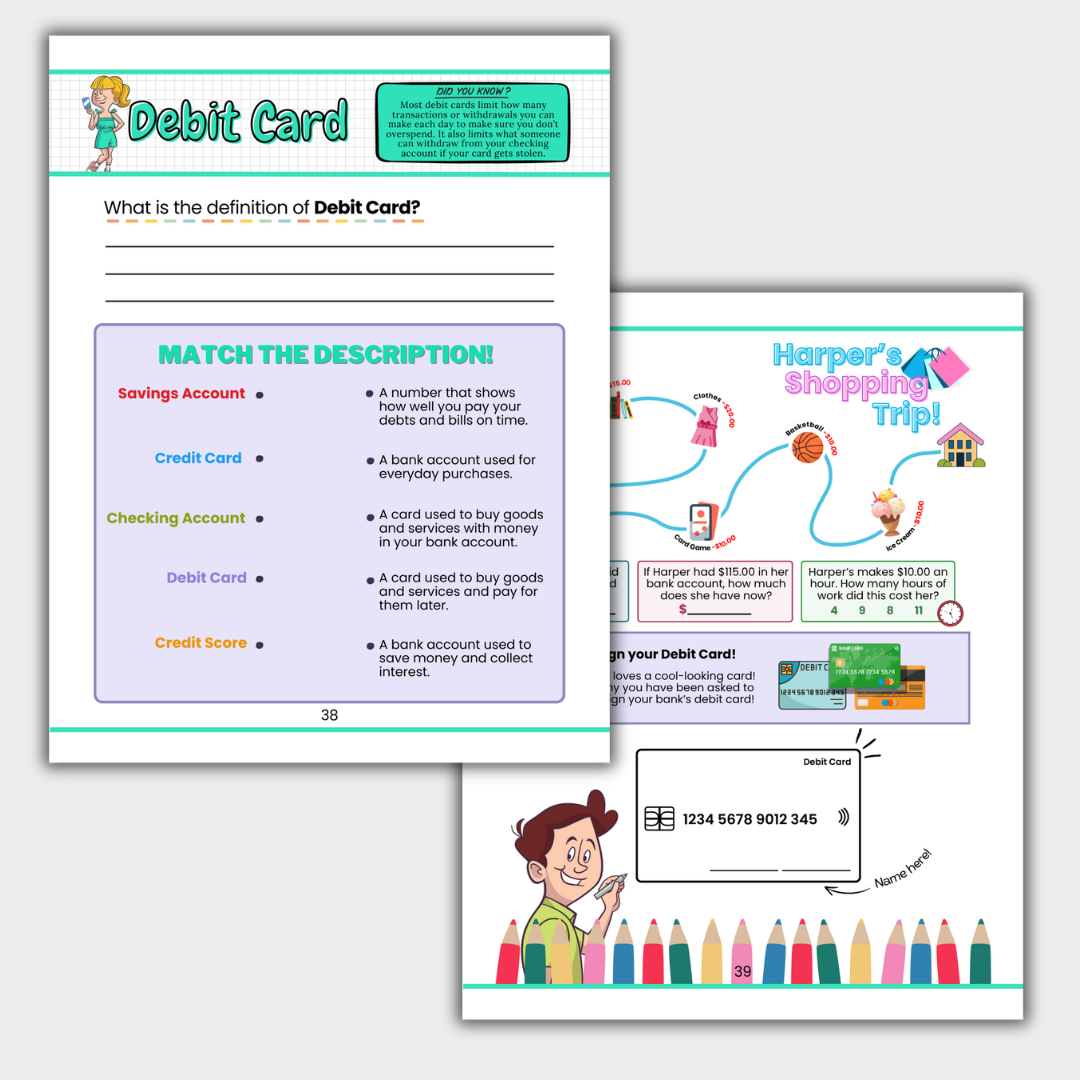

Give your child a head start on their financial journey with the Future Fortunes Academy Financial Education Workbook—a 104-page educational tool designed specifically for kids aged 8–12. This engaging and easy-to-follow workbook introduces 52 essential money concepts, including debt, savings, credit cards, insurance, taxes, investing, and more.Whether your child is curious about how money works or just starting to learn the basics, this workbook brings each topic to life through colorful visuals, relatable scenarios, and interactive learning.

View full details